The African continent has witnessed a meteoric rise in mobile money adoption, transforming how people send and receive money. While mobile money has become ubiquitous for local transactions, its impact is reaching far beyond borders, revolutionizing the way people send money internationally.

If you’re looking for the best mobile money apps for international transfers in Africa, this comprehensive guide is for you. We’ll delve into the benefits of using mobile money, explore the top-rated apps available, and provide you with the information you need to make an informed decision.

Whether you want to send money to family and friends back home, pay for goods and services abroad, or support a business venture, mobile money offers a convenient, secure, and cost-effective solution.

We understand that navigating the world of mobile money can be overwhelming, especially with the plethora of apps available. That’s why we’ve compiled this in-depth review of the best mobile money apps for international transfers in Africa.

If you’re curious about the broader landscape of financial technology in Africa, you can explore our guides on the best fintech apps for African travel and the transformative power of digital currency in Africa. These articles provide valuable insights into how technology is shaping the financial landscape across the continent.

By the end of this article, you’ll have a clear understanding of the top mobile money apps available, their features, fees, and overall suitability for your international transfer needs. Let’s dive in and discover the best way to send money across borders using your mobile phone.

In This Article

Understanding Mobile Money for International Transfers

So, what exactly is mobile money? It’s a financial service that allows you to store, send, and receive money using your mobile phone. Think of it as a digital wallet that you carry in your pocket. It’s particularly popular in Africa, where traditional banking infrastructure may be limited.

With mobile money, you can easily send money to friends and family, pay bills, and even buy goods and services. And when it comes to international transfers, mobile money offers a convenient and often more affordable alternative to traditional banks or money transfer operators.

Why Use Mobile Money for International Transfers?

Mobile money boasts several advantages that make it an appealing choice for sending money abroad:

- Speed: Transfers are often completed within minutes, far faster than traditional bank transfers that can take days.

- Affordability: Mobile money transfers typically come with lower fees compared to banks and some other money transfer services.

- Convenience: You can send money anytime, anywhere, directly from your phone, without the need to visit a physical location.

- Accessibility: Mobile money reaches even remote areas where traditional banking services are unavailable.

- Security: Reputable mobile money providers employ robust security measures to protect your transactions.

If you’re specifically interested in understanding the differences between mobile money and cryptocurrency for international transfers, our article “Mobile Money vs Cryptocurrency: Which is Right for You in Ghana?” provides a detailed comparison to help you make an informed choice.

Important Considerations When Choosing a Mobile Money App

Before you choose a mobile money app for international transfers, there are a few crucial factors to consider:

- Fees and Exchange Rates: Compare the fees charged by different apps and the exchange rates offered to ensure you get the best deal.

- Supported Countries: Verify that the app supports both your sending and receiving countries.

- Transfer Speed: Determine how quickly you need the money to arrive at its destination.

- Security: Prioritize apps with strong security features to protect your financial information.

- Ease of Use: Opt for an app with a user-friendly interface that is easy to navigate.

In the next section, we’ll dive into the top mobile money apps for international transfers in Africa, helping you compare their features and choose the best one for your needs.

Top Mobile Money Apps for International Transfers in Africa

Now that you understand the basics of mobile money, let’s explore some of the leading apps you can use to send money internationally within Africa and beyond.

Comparison of Top Mobile Money Apps for International Transfers

| App | Key Features | Pros | Cons | Fees & Exchange Rates | Supported Countries (Examples) |

|---|---|---|---|---|---|

| WorldRemit | Wide range of payout options (bank deposit, cash pickup, etc.) | Large network, fast transfers | Fees can vary, exchange rates not always the best | Varies based on destination & amount | Kenya, Nigeria, Ghana, South Africa |

| Sendwave | Focuses on sending money to mobile wallets | User-friendly interface, fast transfers, no fees to recipient | Limited payout options, mainly to mobile wallets | Typically no fees, competitive rates | Nigeria, Ghana, Kenya, Uganda |

| Wise | Transparent fees, mid-market exchange rate | Very competitive exchange rates, good for larger amounts | Not available in all African countries | Low fees, real-time exchange rate | South Africa, Nigeria, Ghana |

| Azimo | Offers various payout options | Wide range of supported countries, competitive exchange rates | Less popular in some African countries | Varies based on destination & amount | Kenya, Nigeria, Ghana, Uganda |

WorldRemit

WorldRemit is a global leader in international money transfers, and it’s widely used across Africa. One of its standout features is the wide range of payout options it offers, including bank deposits, cash pickup, mobile money, and airtime top-up. This flexibility makes it a convenient choice for sending money to various destinations.

Pros:

- Extensive network: WorldRemit supports a vast number of countries worldwide.

- Fast transfers: Money often arrives within minutes.

- Multiple payout options: Choose the most convenient method for the recipient.

Cons:

- Fees can vary: Costs depend on the sending and receiving countries, as well as the amount transferred.

- Exchange rates may not always be the best: While competitive, WorldRemit’s exchange rates may not always match those of specialized providers like Wise.

In the next sections, we’ll delve into the specifics of other popular mobile money apps, exploring their features, pros, and cons to help you find the perfect fit for your international transfer needs.

Other Notable Apps

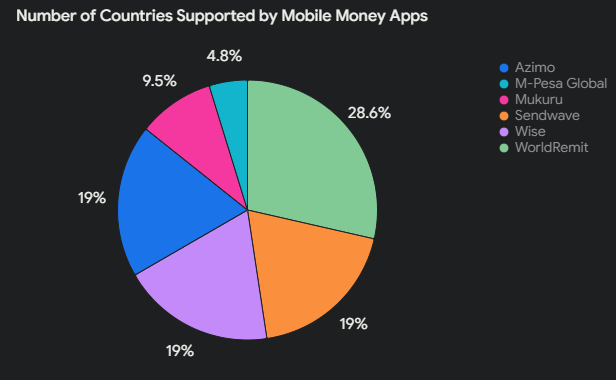

While WorldRemit, Sendwave, Wise, and Azimo are among the most popular choices, other mobile money apps are gaining traction in Africa. Mukuru, a South African company, offers a convenient way to send money within Africa and internationally. M-Pesa Global, an extension of the widely used M-Pesa service, allows users in select countries to send money to M-Pesa accounts across borders.

These are just a few examples of the many mobile money apps available in Africa. It’s essential to research and compare different options to find the one that best suits your individual needs and preferences.

How to Choose the Best Mobile Money App for You

With so many options available, how do you decide which mobile money app is right for you? Here’s a breakdown of the key factors to consider:

- Fees and Exchange Rates:

The cost of sending money can vary significantly between different apps. Compare the fees charged for each transaction and the exchange rates offered. Look for apps that offer transparent pricing and competitive exchange rates to maximize the value of your money. You can use online comparison tools like SaveOnSend to compare the fees and exchange rates of different providers.

- Supported Countries:

Not all mobile money apps operate in every country. Before you choose an app, ensure that it supports both your sending and receiving locations. Check the app’s website or app store listing for a list of supported countries.

- Transfer Speed:

The time it takes for your money to reach its destination can vary depending on the app and the specific transfer route. If speed is a priority, look for apps that offer instant or near-instant transfers. However, keep in mind that faster transfers may sometimes come with higher fees.

- Security:

Security is paramount when it comes to financial transactions. Choose an app with robust security measures, such as two-factor authentication, data encryption, and fraud protection. Look for apps that are regulated by reputable financial authorities and have positive reviews regarding security.

- Ease of Use:

The app you choose should be user-friendly and easy to navigate. Look for an intuitive interface, clear instructions, and responsive customer support. If you’re new to mobile money, consider starting with an app known for its simplicity.

In the next section, we’ll share some additional tips for sending money safely and securely, ensuring your international transfers go smoothly.

Additional Tips for Sending Money to Africa

To ensure you get the most out of your mobile money transfers to Africa, keep these extra tips in mind:

- Compare Exchange Rates:

Exchange rates can fluctuate, so it’s worth comparing rates from different providers before you send money. Use online tools like XE Currency Converter or Google Finance to see the latest rates and find the best deal. Keep in mind that some apps may offer better rates for specific currencies or transfer amounts.

- Send Larger Amounts:

Some mobile money apps offer lower fees or better exchange rates for larger transfers. If you need to send a significant amount of money, consider doing so in a single transaction rather than multiple smaller ones. This can save you money in the long run.

- Plan Ahead:

While mobile money transfers are often fast, they can still take some time to process, especially for international transactions. If you need the money to arrive by a specific date, plan and initiate the transfer well in advance. This will help avoid any unexpected delays and ensure that your recipient receives the funds on time.

By following these additional tips, you can further optimize your mobile money transfers to Africa and get the most value for your money. With careful planning and research, you can send money across borders with ease and confidence.

Now that you’re armed with information about the top mobile money apps and essential tips for sending money to Africa, it’s time to choose the app that best suits your needs. In the next section, we’ll conclude our guide with a final overview and recommendations.

Your Best Mobile Money Apps for International Transfers in Africa

In conclusion, mobile money has emerged as a game-changer for international transfers in Africa, offering a fast, affordable, and convenient alternative to traditional methods. With a wide array of apps available, you can easily send money to loved ones, pay for goods and services, or support businesses across borders.

We’ve explored some of the best mobile money apps for international transfers, each with its own unique strengths and features.

WorldRemit stands out for its extensive network and diverse payout options, while Sendwave shines with its user-friendly interface and focus on mobile wallet transfers.

Wise offers highly competitive exchange rates, especially for larger amounts, and Azimo boasts a broad reach across many African countries.

Remember to consider factors like fees, exchange rates, supported countries, transfer speed, and security when choosing the right app for you. Don’t forget to compare exchange rates, potentially send larger amounts to take advantage of lower fees, and plan your transfers in advance.

By following the tips and insights shared in this article, you’re well-equipped to navigate the world of mobile money and make informed decisions about international transfers. So, what are you waiting for? Embrace the convenience and affordability of mobile money and start sending money with ease today.

Are you ready to explore more digital financial solutions in Africa? Check out our article on “Empowerment with Digital Wallets in Ghana: Explore 5 Game-Changing Options” to discover other innovative tools for managing your money.

FAQs About International Mobile Money Transfers in Africa

1. Is mobile money safe for international transfers?

Yes, reputable mobile money apps employ robust security measures like encryption and two-factor authentication to protect your transactions.

2. Which mobile money app is the cheapest for sending money to Africa?

The cheapest app depends on the specific countries and amount you’re sending. Compare fees and exchange rates using tools like

SaveOnSend

to find the best deal.

3. Can I send money from any country to Africa using mobile money?

Most mobile money apps support a wide range of countries, but it’s essential to check the app’s list of supported countries before you start a transaction.

4. How long does it take to send money internationally using mobile money?

Transfer speeds vary, but many apps offer instant or near-instant transfers, making them a much faster option than traditional bank transfers.

5. What should I do if I encounter problems with my mobile money transfer?

If you face any issues, contact the app’s customer support immediately. They can help you troubleshoot problems and resolve any concerns you may have.

Discover more from Ken Arhin

Subscribe to get the latest posts sent to your email.