Table of Contents

Practical Personal Finance Tips for Beginners: Managing personal finances is crucial for achieving financial stability and reaching long-term goals.

By taking control of your money, you can ensure a secure future, reduce financial stress, and make informed decisions about spending and saving.

Whether you aim to get out of debt, save for a significant purchase, or start investing, having a solid financial plan is essential.

In this post, readers will learn practical tips on creating a budget, saving money effectively, and starting to invest. We will cover essential topics such as budgeting basics, setting financial goals, building an emergency fund, and understanding investment options.

By the end of this article, you will have a clear understanding of how to manage your finances better and make your money work for you.

Budgeting

How to Create a Budget for Beginners

Creating a budget is the cornerstone of effective personal finance management. A well-structured budget helps you understand where your money goes, ensuring you live within your means and reach your financial goals.

Step-by-Step Guide to Creating a Budget:

Track Your Income and Expenses

- Start by listing all sources of income, including your salary, freelance earnings, rental income, and any other regular inflows of money.

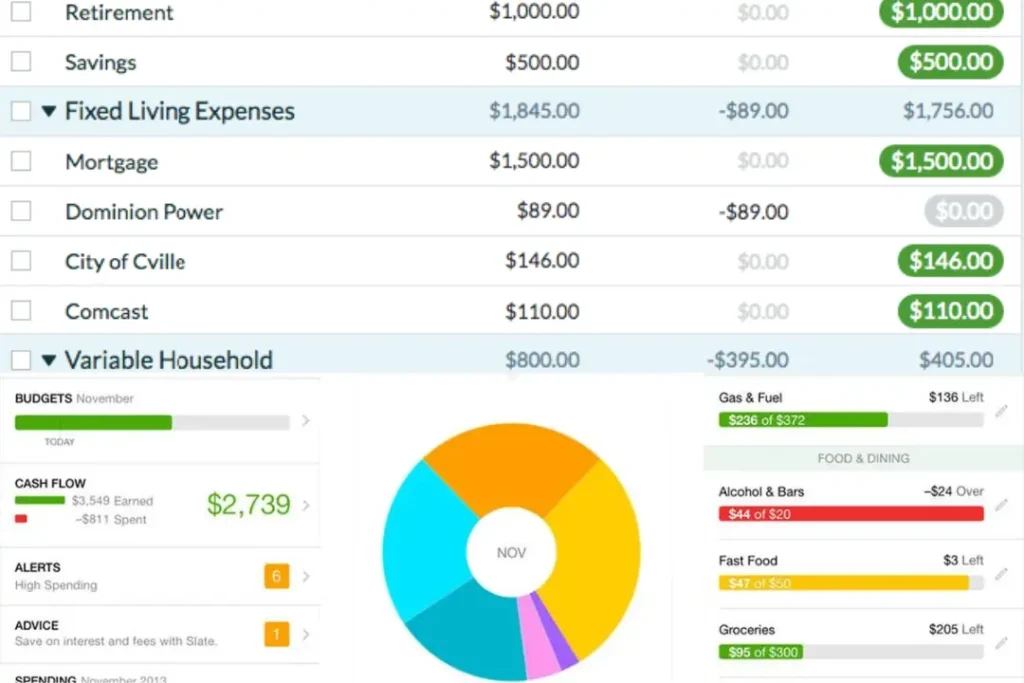

- Use tools like Mint, YNAB (You Need A Budget), or simple spreadsheets to monitor your financial activities.

- Categorize your expenses into essentials (rent, groceries, utilities) and non-essentials (entertainment, dining out) to identify spending patterns.

Categorize Expenses

- Differentiate between essential expenses such as rent, groceries, and utilities, and non-essential expenses like entertainment and dining out.

- This differentiation will help you see where you can cut back if needed.

Set Financial Goals

- Establish clear financial goals to provide direction and motivation. Goals can be short-term, like saving for a vacation, or long-term, such as buying a house or saving for retirement.

Adjust as Necessary

- Budgeting is not a one-time task but an ongoing process. Regularly review your budget and make adjustments as your financial situation changes.

- Conduct monthly reviews to compare your actual spending with your budgeted amounts and make necessary adjustments.

- Perform quarterly reviews to reassess your financial goals and adjust your budget accordingly.

Step-by-Step Guide to Financial Planning:

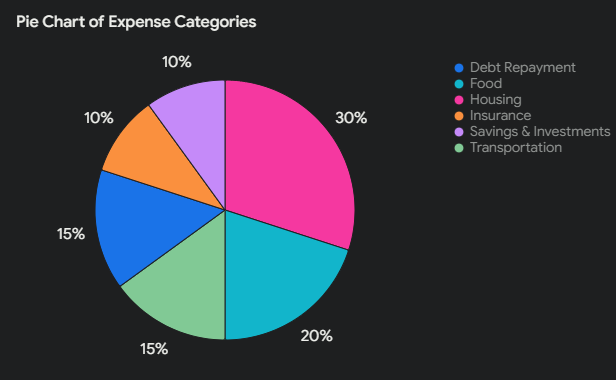

1. Use the 50/30/20 Rule

Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This rule simplifies budgeting by providing a clear framework for managing your money.

2. Automate Bill Payments

Automating bill payments helps avoid late fees and ensures essential expenses are covered first. This step also saves time and reduces the risk of missing due dates.

3. Regularly Review and Adjust

Consistent review and adjustment of your budget help you stay on track and make informed decisions about your finances. Regularly revisiting your budget ensures it remains aligned with your financial goals and current circumstances.

Tips for Effective Budgeting:

- Use the 50/30/20 Rule: Follow this rule to allocate your income efficiently and manage your finances better.

- Automate Bill Payments: Set up automatic payments to avoid late fees and ensure your essential expenses are always covered.

- Review and Adjust Regularly: Consistently review your budget to stay on track and make necessary adjustments as your financial situation changes.

For more detailed guidance on budgeting, check out resources like Ramsey Solutions’ Guide on How to Make a Budget, Investopedia’s Budgeting Guide, and NerdWallet’s Budgeting Tips.

By following these practical personal finance tips for beginners, you can create a solid budget that supports your financial goals. Regularly revisiting and tweaking your budget will help ensure you stay on track and make informed financial decisions.

Saving

Simple Ways to Save Money Each Month

Practical Personal Finance Tips for Beginners: Saving money is essential for handling emergencies, making significant purchases, and ensuring future financial security. Here’s how you can start saving effectively:

- Importance of Saving for Emergencies, Big Purchases, and Future Security Saving money provides a safety net for unexpected expenses, helps you make significant purchases without going into debt, and ensures you have funds for future needs like retirement. Building an emergency fund is a critical first step.

- Steps to Build an Emergency Fund (3-6 Months of Living Expenses)

- Determine Your Monthly Expenses: Calculate your essential monthly expenses such as rent, groceries, utilities, and transportation. This total is what you’ll aim to save for your emergency fund.

- Set a Savings Goal: Aim to save 3-6 months of your essential living expenses. If your monthly expenses are $2,000, your emergency fund goal would be between $6,000 and $12,000.

- Start Small and Automate: Begin by saving a small, manageable amount each month. Automate transfers to your savings account to ensure consistency. Using apps like Acorns or Qapital can help you save effortlessly by rounding up your purchases and saving the change. This “spare change” approach can quickly add up and contribute to your emergency fund.

Tips for Automating Savings and Cutting Unnecessary Expenses

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account. This method ensures you save consistently without having to think about it.

- Cut Unnecessary Expenses: Review your spending habits to identify areas where you can cut back. Consider dining out less frequently, canceling unused subscriptions, and avoiding impulse purchases.

Effective Tips for Building an Emergency Fund

- Pay Yourself First One of the most effective strategies for saving money is to pay yourself first. This means automatically transferring a portion of your income into savings before you spend on anything else. For example, if you receive a paycheck, set up an automatic transfer of a fixed amount to your savings account. This approach prioritizes savings and helps you build your emergency fund faster.

- Cut Unnecessary Expenses To increase your savings rate, it’s essential to cut unnecessary expenses. Start by reviewing your monthly subscriptions and canceling those you don’t use. Evaluate your dining-out habits and consider cooking at home more often. Impulse purchases can also drain your finances, so try to make thoughtful, planned purchases instead.

- Use Savings Apps Utilizing savings apps like Acorns and Qapital can make saving money easier and more efficient. These apps round up your everyday purchases to the nearest dollar and save the spare change automatically. Over time, these small amounts can grow significantly and boost your savings.

High-Yield Savings Accounts

Benefits and How to Choose One

A high-yield savings account offers a higher interest rate compared to a regular savings account, allowing your money to grow faster. Here are some benefits and tips for choosing a high-yield savings account:

- Higher Interest Rates: High-yield savings accounts typically offer interest rates significantly higher than traditional savings accounts. This means your money earns more over time.

- Safety and Security: Most high-yield savings accounts are FDIC-insured, meaning your deposits are protected up to $250,000 per account holder, per bank.

- Accessibility: While high-yield savings accounts offer higher interest rates, they still provide easy access to your money when you need it.

When choosing a high-yield savings account, consider the following factors:

- Interest Rate: Compare rates from different banks to find the best offer. Websites like Bankrate can help you compare current rates.

- Fees: Look for accounts with no monthly maintenance fees and low minimum balance requirements.

- Accessibility: Ensure you can easily access your money when needed, either through online banking, mobile apps, or a local branch.

By following these practical personal finance tips for beginners, you can effectively save money each month and build a robust emergency fund.

Automating your savings, cutting unnecessary expenses, and utilizing high-yield savings accounts are key strategies to achieve financial stability and security.

Investing

Easy Investment Strategies for Beginners

Practical Personal Finance Tips for Beginners: Investing is a crucial step in personal finance that can lead to higher returns, help beat inflation, and grow your wealth over time. Understanding different investment options and strategies is essential for beginners looking to start their investment journey.

Why Investing is Important

Investing is important because it offers the potential for higher returns compared to traditional savings methods. By investing, you can grow your wealth, achieve financial independence, and secure your financial future. Here are some key reasons why investing is essential:

- Higher Returns: Investments typically offer higher returns than savings accounts, helping your money grow faster.

- Beating Inflation: Investing helps protect your purchasing power by outpacing inflation, ensuring your money retains its value over time.

- Growing Wealth: Through compounding returns, investments can significantly increase your wealth over the long term.

Overview of Different Investment Options

1. Stocks:

- Ownership in Companies: When you buy stocks, you own a piece of the company. Stocks offer high potential returns but come with higher risk.

- Higher Risk, Higher Reward: Stocks can be volatile, but they generally provide higher returns over the long term. For more on stocks, check out Investopedia’s Guide to Stock Market Investing.

2. Bonds:

- Loans to Government or Companies: Bonds are debt securities where you lend money to an entity in exchange for periodic interest payments and the return of the principal at maturity.

- Lower Risk, Lower Reward: Bonds are less risky than stocks but usually offer lower returns. Learn more about bonds from NerdWallet’s Bonds Basics.

3. Mutual Funds and ETFs:

- Diversified Investment Options: These funds pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets.

- Managed by Professionals: Mutual funds are actively managed, while ETFs typically track an index and are passively managed. The Balance explains the differences.

4. Real Estate:

- Buying Property for Rental Income or Resale: Investing in real estate involves purchasing property to earn rental income or profit from appreciation.

- Long-Term Growth: Real estate can be a stable investment that grows over time. For a beginner’s guide, visit Investopedia’s Real Estate Investment.

5. Cryptocurrencies:

- High-Risk Digital Assets: Cryptocurrencies are digital or virtual currencies that use cryptography for security. They are highly volatile and suitable for investors with a high risk tolerance.

- Potential for High Returns: Cryptocurrencies can offer substantial returns but come with significant risks. CoinDesk provides more insights.

Smart Investing Tips for First-Time Investors

1. Educate Yourself

- Read Books: Books like “The Intelligent Investor” by Benjamin Graham provide foundational knowledge.

- Take Courses: Online courses from platforms like Coursera or Udemy can help you understand investment principles.

- Follow Reputable Finance Websites: Websites such as Investopedia and NerdWallet offer valuable insights and tips.

2. Start Small

Begin with a small amount of money and gradually increase your investments as you become more comfortable and knowledgeable. This approach allows you to learn without risking too much capital initially.

3. Use Robo-Advisors

Platforms like Betterment and Wealthfront manage investments based on your risk tolerance and financial goals. Robo-advisors provide a hands-off approach to investing, making it easier for beginners to get started.

For beginners, robo-advisors like Betterment or Wealthfront offer an easy entry into the world of investing. These platforms use digital payment systems to manage your investments efficiently. Read more about the benefits of digital payment solutions in our article on Digital Payments: 5 Brilliant Money Hacks!.

4. Diversify Your Portfolio

Spread your investments across different asset classes to mitigate risk. Diversification helps protect your portfolio from significant losses in any single investment. For more on diversification, visit: Diversification: Protect Your Portfolio .

By following these practical personal finance tips for beginners, you can start investing wisely and build a solid financial foundation. Educate yourself, start small, use robo-advisors, and diversify your portfolio to achieve your investment goals and secure your financial future.

Final Thoughts: Practical Personal Finance Tips for Beginners

Recap Key Points

In this post, we’ve explored practical personal finance tips for beginners focusing on budgeting, saving, and investing. Here’s a summary of the key points:

1. Budgeting:

Importance: Creating a budget is fundamental for managing personal finances effectively. It helps track income and expenses, set financial goals, and ensure financial stability.

Steps: Track income and expenses, categorize expenses, set financial goals, and regularly review and adjust the budget.

Tips: Use the 50/30/20 rule, automate bill payments, and consistently review your budget.

2. Saving:

Importance: Saving money is crucial for handling emergencies, making significant purchases, and ensuring future financial security.

Steps: Build an emergency fund with 3-6 months of living expenses, automate savings, and cut unnecessary expenses.

Tools: Use savings apps like Acorns and Qapital, and consider high-yield savings accounts for better returns.

3. Investing:

Importance: Investing is essential for achieving higher returns, beating inflation, and growing wealth.

Options: Stocks, bonds, mutual funds, ETFs, real estate, and cryptocurrencies.

Tips: Educate yourself, start small, use robo-advisors like Betterment and Wealthfront, and diversify your portfolio to mitigate risk.

Starting your journey in managing personal finances can seem daunting, but remember that small, consistent steps can lead to significant financial improvement over time.

Begin with simple actions like creating a budget and building an emergency fund, then gradually explore investment opportunities as you gain confidence and knowledge.

Feel free to share your own tips or ask questions in the comments section. Your insights and queries can help others on their personal finance journey, and we’re here to support you every step of the way.

1. What is the best way to start budgeting?

The best way to start budgeting is by tracking your income and expenses. Use tools like Mint or YNAB (You Need A Budget) to help categorize your expenses and identify areas where you can cut back. Set financial goals and regularly review and adjust your budget to stay on track.

2. How much should I save for an emergency fund?

It is recommended to save 3-6 months’ worth of living expenses in an emergency fund. This fund should be easily accessible and kept in a high-yield savings account to earn some interest while keeping your money safe for unexpected expenses (SoFi).

3. What are some effective ways to save money each month?

Some effective ways to save money each month include automating your savings, cutting unnecessary expenses like subscriptions and dining out, and using savings apps like Acorns or Qapital. Reviewing your budget regularly to find additional savings opportunities can also be helpful (SoFi).

4. Why is investing important for financial growth?

Investing is important for financial growth because it helps you achieve higher returns compared to traditional savings. It also helps you beat inflation and grow your wealth over time. Diversifying your investments across different asset classes like stocks, bonds, real estate, and mutual funds can help mitigate risks and improve your financial stability (NerdWallet: Finance smarter).

5. What are some beginner-friendly investment options?

Beginner-friendly investment options include stocks, bonds, mutual funds, ETFs (Exchange-Traded Funds), and real estate. Using robo-advisors like Betterment or Wealthfront can also be beneficial as they manage investments based on your risk tolerance and financial goals (NerdWallet: Finance smarter) (SoFi).

Discover more from Ken Arhin

Subscribe to get the latest posts sent to your email.