Table of Contents

The African continent is experiencing a mobile money revolution, with over 500 million registered users. This explosive growth has led to a fierce battle among fintech giants vying for dominance.

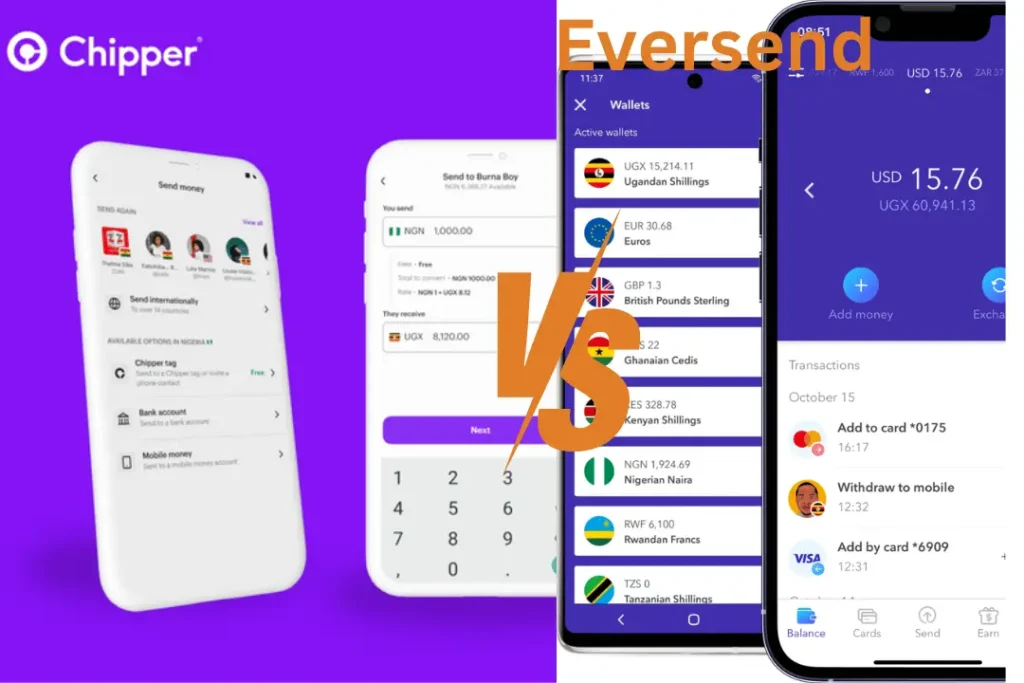

Two of the leading contenders in this arena are Chipper Cash and Eversend, both offering innovative solutions for individuals and businesses across Africa.

But which one reigns supreme? This blog post will delve into the heart of this battle, examining the strengths and weaknesses of each platform.

We’ll compare features, fees, and target audiences to help you decide which mobile money app best suits your financial needs. So, buckle up and get ready for a head-to-head showdown between Chipper Cash vs Eversend!

Chipper Cash: The Cross-Border Challenger

Chipper Cash, founded in 2014, has quickly become a leading fintech platform for Africans, particularly those seeking a simple and affordable way to send and receive money across borders.

Its target audience is individuals and small businesses within its seven-country network: Ghana, Uganda, Kenya, Nigeria, Rwanda, South Africa, and Tanzania.

One of Chipper Cash’s greatest strengths is its commitment to free transfers within its network. This makes it a highly attractive option for sending money between friends and family within Africa. Additionally, the app boasts a user-friendly interface that is perfect for tech novices.

Beyond the core money transfer service, Chipper Cash has expanded its offerings to include bill payments, airtime top-ups, and even investment options. This diversification further enhances its appeal to a broader audience.

However, Chipper Cash also faces some limitations. Its service is not yet available in as many countries as some competitors, and certain features, like virtual dollar cards and access to US investments, are still missing.

Additionally, while transfers within its network are free, international transfers and other services may incur fees, which might deter some users.

When considering Chipper Cash vs Eversend, it’s crucial to weigh your priorities. If you primarily need a simple and affordable way to send and receive money within Africa, Chipper Cash’s free transfers and user-friendly interface are difficult to beat.

However, if you require a broader range of services, including virtual dollar cards and international investments, Eversend might be a better fit.

Eversend: The Multi-Currency Powerhouse

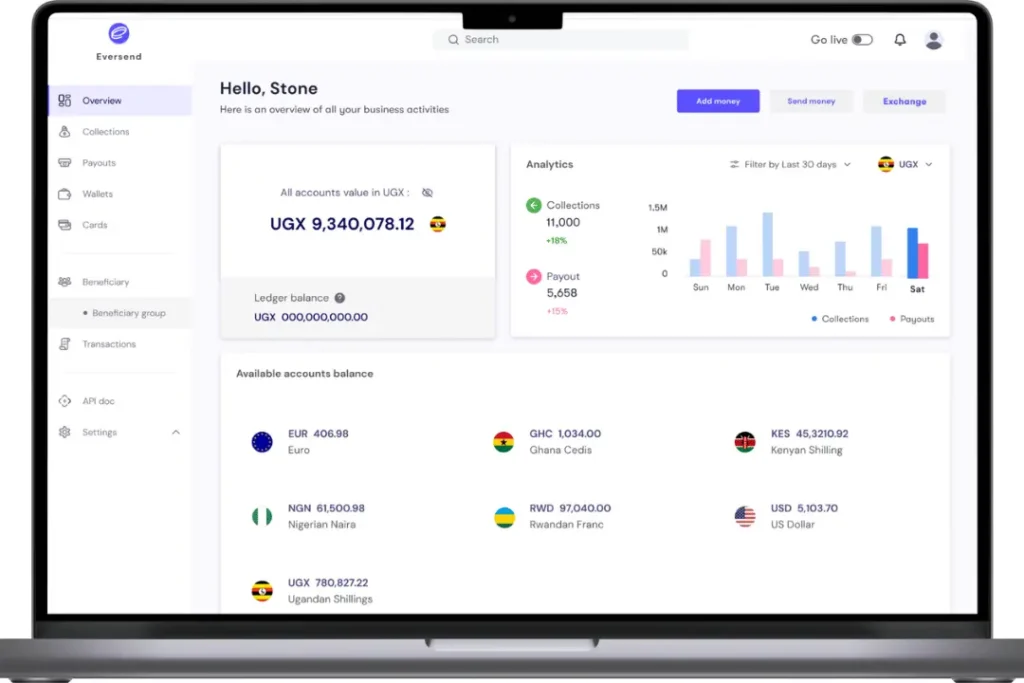

Eversend, launched in 2017, has established itself as a comprehensive financial solution for individuals and businesses seeking a wider range of services beyond basic cross-border transfers.

Unlike Chipper Cash, its services extend beyond Africa, encompassing nine countries within the continent and reaching the UK and Europe as well. This broader reach makes it a strong contender in the Chipper Cash vs Eversend battle.

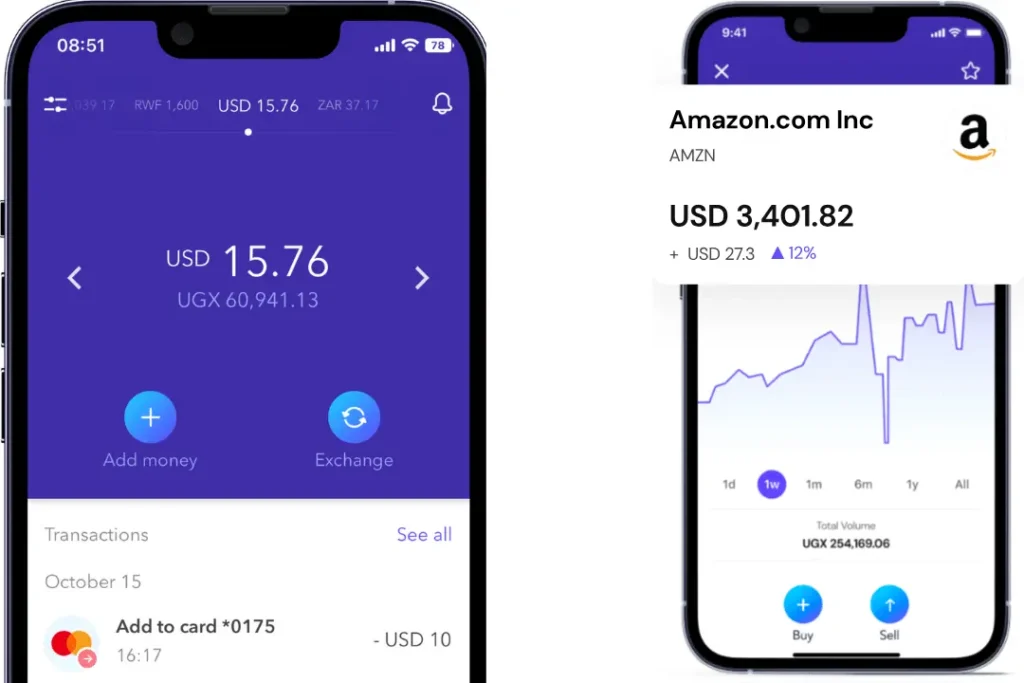

Eversend’s strength lies in its diverse offering. Its unique features like virtual dollar cards provide unparalleled flexibility for international payments, while the multi-currency wallets allow users to manage various currencies seamlessly.

Additionally, Eversend recently launched access to US stocks and ETFs, opening up new investment opportunities for its users.

However, while Eversend offers a wider range of services, this comes at a price. Compared to Chipper Cash, Eversend charges a 1.5% to 3.5% fee on foreign exchange rates for cross-border transfers.

Additionally, other services may incur additional fees. This higher cost structure might discourage budget-conscious users.

Choosing between Chipper Cash vs Eversend depends on your specific needs and priorities. If you require a platform with a diverse range of services, including virtual dollar cards, multi-currency wallets, and access to international investments, Eversend presents a compelling option.

However, if you prioritize affordability and primarily focus on sending and receiving money within Africa, Chipper Cash’s free transfers might be more appealing.

Chipper Cash vs Eversend: Head-to-Head Comparison

| Feature | Chipper Cash | Eversend |

|---|---|---|

| Services | Cross-border transfers, bill payments, airtime top-up, investments | Cross-border transfers, virtual dollar cards, multi-currency wallets, bill payments, access to US stocks & ETFs |

| Fees | Free transfers within the network, fees for international transfers, and other services | 1.5% to 3.5% fee on foreign exchange rates for cross-border transfers, additional fees for other services |

| Availability | Free transfers within the network, user-friendly interface, investment options | Ghana, Uganda, Kenya, Nigeria, Rwanda, South Africa, Tanzania, Malawi, Zambia, UK, Europe |

| Target Audience | Individuals sending money within Africa | Individuals & businesses with diverse financial needs |

| Strengths | Free transfers within network, user-friendly interface, investment options | Diverse services, virtual dollar cards, multi-currency wallets, access to US stocks & ETFs |

| Weaknesses | Diverse services, virtual dollar cards, multi-currency wallets, access to US stocks & ETFs | Higher fees than Chipper Cash for specific services |

Specific Use Cases:

Sending money within Africa:

- Chipper Cash: Ideal choice due to free transfers within its network, making it cost-effective for frequent transfers.

- Eversend: Not as cost-effective for frequent transfers due to fees.

Making international payments:

- Chipper Cash: Fees may apply, making Eversend a more cost-effective option for regular international transfers.

- Eversend: Virtual dollar cards offer flexibility and convenience for international payments.

Accessing US investments:

- Chipper Cash: No direct access to US investments.

- Eversend: Provides access to US stocks and ETFs, making it a suitable choice for those seeking investment opportunities.

Ultimately, the best platform for you depends on your individual needs and priorities. If you prioritize affordability and primarily focus on sending and receiving money within Africa, Chipper Cash is a strong contender.

However, if you require a wider range of services, including virtual dollar cards, multi-currency wallets, and access to international investments, Eversend might be a better fit.

Choosing the Right Platform: Chipper Cash vs Eversend

Navigating the world of mobile money apps can be overwhelming, especially when faced with two powerful contenders like Chipper Cash and Eversend. Both platforms offer compelling features and cater to different user needs, making it crucial to understand your priorities before choosing one.

Chipper Cash shines with its user-friendly interface and free transfers within its network. This makes it an ideal choice for individuals who primarily send and receive money within Africa and prioritize affordability. Additionally, its investment options offer a path for financial growth.

However, Eversend’s diverse range of services sets it apart. From virtual dollar cards to multi-currency wallets and access to international investments, Eversend caters to individuals and businesses with a broader spectrum of financial needs.

While fees for certain services might be higher than Chipper Cash, the added functionality and global reach can be invaluable for specific user profiles.

Ultimately, the “best” platform in the Chipper Cash vs Eversend battle depends on your priorities. To guide your decision, consider the following criteria:

1. Primary Needs:

- Do you primarily need to send and receive money within Africa? If so, Chipper Cash’s free transfers could be a significant advantage.

- Do you require a wider range of services, including international payments, virtual cards, or investment options? Then Eversend might be a better fit.

2. Budget:

- Are cost-effectiveness and free transfers crucial for you? Chipper Cash offers a clear advantage in this aspect.

- Are you willing to pay slightly higher fees for a wider range of services and increased flexibility? If so, Eversend could justify the added cost.

3. Target Audience:

- Are you an individual seeking a simple and affordable way to send money within Africa? Chipper Cash might be your perfect match.

- Are you a business or individual seeking diverse financial services with international reach? Eversend’s capabilities could be more suitable.

Remember, there’s no one-size-fits-all solution. By carefully analyzing your needs and priorities against the strengths and weaknesses of Chipper Cash and Eversend, you can make an informed decision and choose the platform that best empowers your financial journey.

Choosing Your Champion in the Chipper Cash vs Eversend Match

Both Chipper Cash and Eversend offer innovative solutions for mobile money needs in Africa. Chipper Cash tempts users with its user-friendly interface, free transfers within its network, and investment options, making it a strong contender for individuals primarily focused on sending and receiving money within the continent.

Eversend stands out with its wide array of services like virtual dollar cards, multi-currency wallets, and US investment access, catering to individuals and businesses with comprehensive financial needs and a global presence.

Ultimately, the victor in the Chipper Cash vs Eversend battle depends on your unique priorities. Whether you prioritize affordability and convenience or seek a wider range of services with international capabilities, understanding your specific needs and financial goals is key to making an informed decision.

Before you declare your champion, be sure to thoroughly research and compare features. Both platforms offer valuable resources on their websites and mobile apps, providing detailed information about their services, fees, and target audiences.

Additionally, reading online reviews and user testimonials can offer valuable insights into the real-world experiences of others.

Remember, your financial journey is unique. Don’t hesitate to share your experiences with Chipper Cash and Eversend in the comments section below.

By engaging in this discussion, we can collectively learn from each other and navigate the ever-evolving landscape of mobile money in Africa together.

Let the Chipper Cash vs Eversend battle commence! Choose your champion wisely and embark on a journey of financial empowerment.

Chipper Cash vs Eversend: Frequently Asked Questions

1. Which app is better than Chipper Cash?

The answer depends heavily on your specific needs and priorities. Chipper Cash shines with its free transfers within its network and user-friendly interface, making it ideal for sending and receiving money within Africa.

However, Eversend boasts a wider range of services, including virtual dollar cards, multi-currency wallets, and access to US investments, catering to individuals and businesses with more diverse needs.

Ultimately, the “better” app depends on whether you prioritize affordability and simplicity or a broader range of services and global reach.

2. Which is better Chipper Cash or PayDay?

Both Chipper Cash and PayDay are popular mobile money apps in Africa, each offering distinct advantages. Chipper Cash excels in free transfers within its network, airtime top-ups, and investment options.

PayDay, on the other hand, offers competitive exchange rates for international transfers and bill payments. The “better” app for you depends on your primary needs. If you primarily transfer money within Africa, Chipper Cash might be a good choice. But if you require frequent international transfers and bill payments, PayDay could be more suitable.

3. Which bank owns Chipper Cash?

Chipper Cash is a privately owned company and is not owned by any bank. It has raised significant funding from various investors, including VC firms and angel investors.

4. What makes Chipper Cash different?

Chipper Cash differentiates itself through its focus on user-friendliness, affordability, and expansion within Africa. Its free transfers within its network and simple interface make it accessible to everyone. Additionally, its growing presence across African countries promotes financial inclusion and regional integration.

5. Does Eversend work in Ghana?

Yes, Eversend operates in Ghana, offering its full range of services. This includes cross-border transfers, virtual dollar cards, multi-currency wallets, bill payments, and access to US stocks and ETFs.

6. Is Eversend real or fake?

Eversend is a legitimate and licensed financial technology company. It operates under the regulatory oversight of various financial authorities in the countries it operates in. Additionally, it has built a strong reputation among users for its reliability and security.

7. Is Eversend a Nigerian company?

While Eversend has a strong presence in Nigeria and serves a large Nigerian user base, it is not a Nigerian company. It was founded in France and has a global team of employees.

8. How does Eversend work?

Eversend operates as a mobile app and web platform. Users can sign up, create an account, and connect their bank accounts or mobile money wallets to access its services.

These services include sending and receiving money, holding funds in different currencies, making international payments with virtual dollar cards, and investing in US stocks and ETFs.

By providing answers to these frequently asked questions, we aim to help readers understand the key differences between Chipper Cash and Eversend and choose the platform that best suits their needs.

Discover mobile money solutions in Ghana. Explore my blog for insights, tutorials, and my guide to creating a free virtual card: “3 Easy Ways to Create a Free Virtual Card in Ghana.” Subscribe to our newsletter for regular updates and tips.

This article is very informative.