Table of Contents

Gone are the days of bulky wallets and endless queues in Ghana. The digital revolution has swept across the nation, transforming how we manage our finances. At the forefront of this transformation are digital wallets, offering unparalleled convenience, security, and a plethora of financial services right at your fingertips.

But with so many options available, choosing the right digital wallet can feel overwhelming. Fear not, fellow Ghanaians! This comprehensive guide dives deep into the top 5 digital wallets dominating Ghana’s cashless landscape, catering to diverse needs and preferences.

5 Top Digital Wallets in Ghana: Your Guide to Going Cashless

1. MTN Mobile Money: The Undisputed King of Convenience

Boasting a staggering 25 million active users, MTN Mobile Money reigns supreme in the convenience department. Deeply integrated into the MTN ecosystem, it seamlessly blends into your daily life. Sending money to loved ones, paying bills, even applying for microloans – it’s all a breeze within the familiar confines of your phone.

Sure, occasional glitches and slightly higher transaction fees might raise an eyebrow. But its intuitive interface and ubiquitous agent network make it a powerhouse for anyone seeking effortless money management.

2. Vodafone Cash: The Tech-Savvy Challenger with Added Perks

Vodafone Cash isn’t just playing catch-up; it’s setting the bar for tech-savvy features. Biometric logins for enhanced security and scheduled payments for ultimate control are just a taste of what it offers. However, its agent network is still playing catch-up to MTN, and transaction limits might deter high-volume users.

3. myghpay: The Secure Bastion Backed by a Banking Giant

With the solid backing of Ghana Commercial Bank, myghpay prioritizes security above all else. Secure fund management and seamless transfers are its forte, even if the interface might feel less intuitive compared to its rivals.

4. Airtel Money: The Newcomer with a Loyalty Edge

Airtel Money, already boasting 15 million users, isn’t just about convenience. Its loyalty program rewards users with redeemable points, turning everyday transactions into opportunities to earn. While its agent network is steadily expanding, its suite of features is constantly evolving, making it a contender to watch.

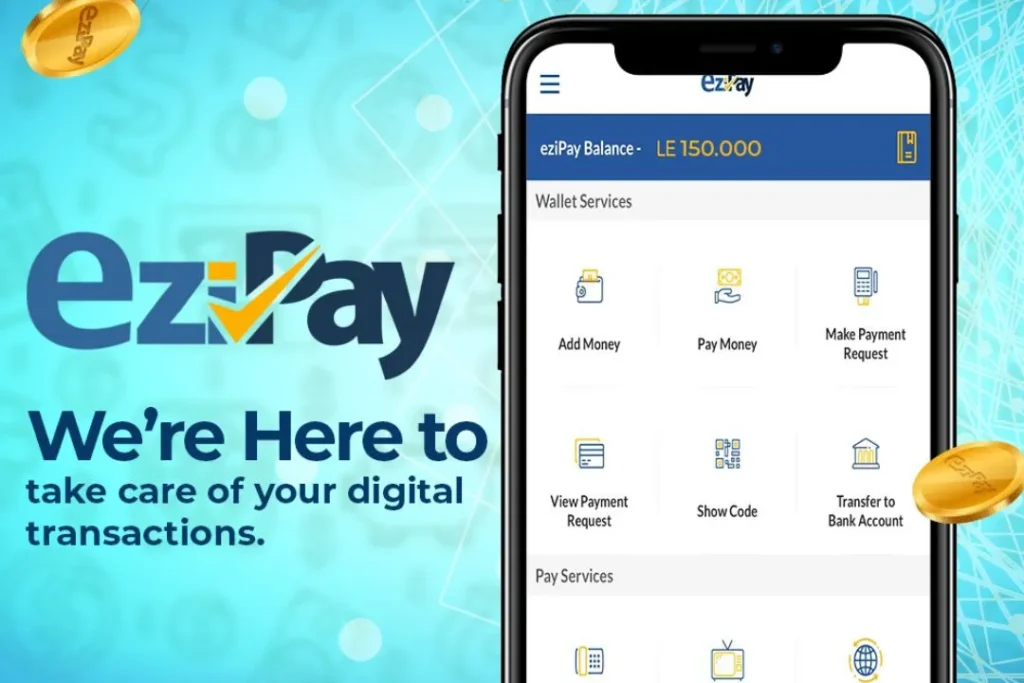

5. EziPay Ghana: The Simple Solution for Everyday Needs

Rapidly gaining traction, EziPay Ghana is the new kid on the block, charming users with its sleek interface and focus on affordability. However, its limited agent network and relatively new status might raise concerns for some.

Choosing Your Perfect Digital Wallet Match

The ideal digital wallet is as unique as you are. Consider your needs: Are you a frequent money sender? Do you prioritize security above all else? Do you need a wallet that seamlessly integrates with your existing financial ecosystem? Smartphone compatibility, fees, and security protocols are also crucial factors to weigh.

Beyond Everyday Transactions: A World of Possibilities

Digital wallets go far beyond simply sending and receiving money. Dive into investment opportunities, send money internationally, access insurance, and even secure micro-loans – all within your digital wallet. The possibilities are endless!

Embrace the Future of Money in Ghana

The digital wallet revolution is here to stay, and Ghana is at the forefront of this exciting transformation. Ditch the bulky cash and embrace the convenience, security, and financial inclusion that digital wallets offer. Remember, the future of money is in your pocket – choose your perfect digital wallet match and start reaping the rewards of a cashless Ghana!

FAQs: Your Digital Wallet Questions Answered

- 1: Which digital wallet is the safest in Ghana? Security is a top priority for all the wallets mentioned. However, myghpay, backed by a reputable bank, might offer some users additional peace of mind.

- 2: Can I use my digital wallet without a bank account? Yes, most wallets allow basic transactions without a bank account. However, certain features and limits might be restricted.

- 3: How do I send money internationally with a digital wallet? Some wallets, like MTN Mobile Money and Airtel Money, offer international money transfer services. Check with your chosen wallet provider for specific details.

- 4: What are the benefits of using a digital wallet for businesses? Digital wallets enable faster payments, improved record-keeping, and access to a wider customer base.

- 5: Where can I find more information about digital wallets in Ghana? The Bank of Ghana website and the websites of individual wallet providers are excellent resources for staying up-to-date

Ready to Simplify Your Finances?

Explore the best digital wallets in Ghana and take control of your money today! Whether you’re looking to make quick transfers, pay bills, or shop online with ease, these top-rated digital wallets have you covered.

Don’t Miss Out! Start your journey towards hassle-free financial management now. Find Your Preferred Wallet and experience the convenience!

Discover more from Ken Arhin

Subscribe to get the latest posts sent to your email.

Informative! I love your content. Keep it up.